We regularly get asked by individuals:

“How can I build my credit score?”

First off you need to understand what your credit score is and what’s on your credit report.

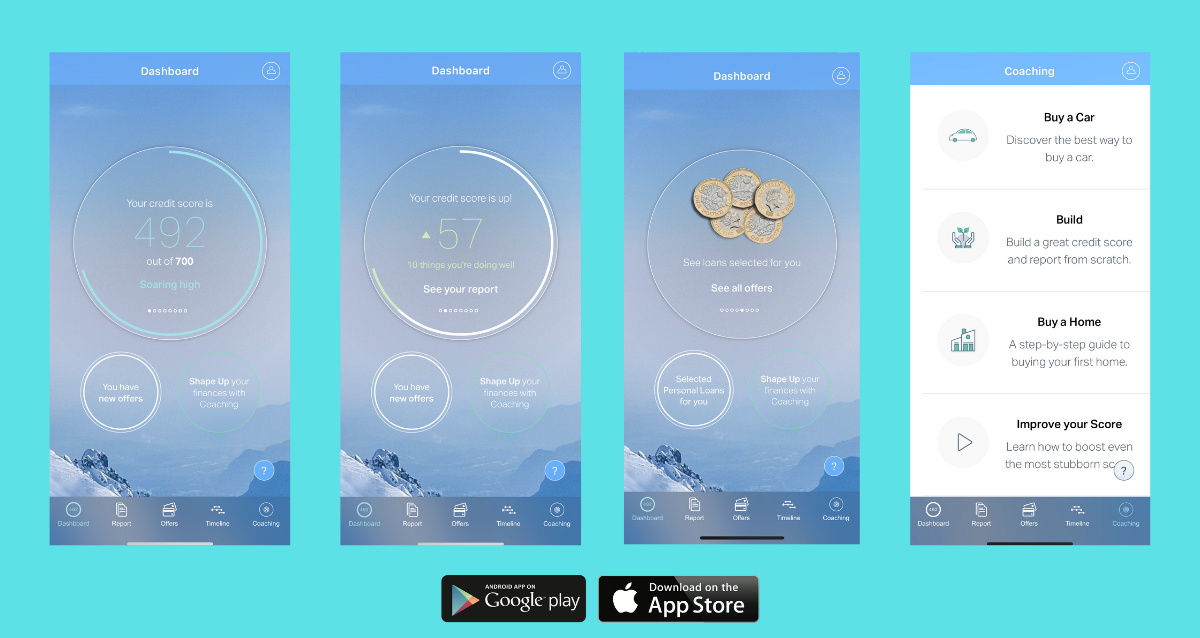

For this, we LOVE ClearScore’s mobile app:

ClearScore is a free app which gives you a free credit report every 30 days. It tells you what is affecting your score and details any movement from your previous months report. It’s really smart and easy to use which allows you to track changes easily, whilst also giving you an overview of any accounts you have and any balances outstanding. They’ll prompt you once a month when your new report is in and give you the ups and downs compared to last month. ClearScore go one further than this, they have setup coaching which allows you to get help on any aspect from getting a new car or applying for a mortgage.

Noddle is another credit agency who give you a free credit report for life. It is always good to get a second opinion and all credit agencies will score you differently, plus you might spot a rogue account on one report but not the other! The mobile app is not as advanced as ClearScore, however, Noddle allow you to login on a computer and ‘Download your full report‘ to PDF. This full report is excellent and gives you full details on all accounts, as well as historic data!

Now, REVIEW your reports:

Once you’re setup with both ClearScore and Noddle, it’s a good idea to crosscheck the information on both reports. Check your accounts line up (although watch out as they may extract account balances at different times each month) and there is nothing on there that shouldn’t be. So many individuals don’t check their credit report and therefore have no idea if someone has opened accounts in your name! If you spot something that doesn’t look right, contact the relevant agency to have it corrected. From this point you will be able to use the improve section of ClearScore to build your credit score and start to be promoted offers that are relevant to your scoring, as well as giving you training on how to improve your score… all for FREE!

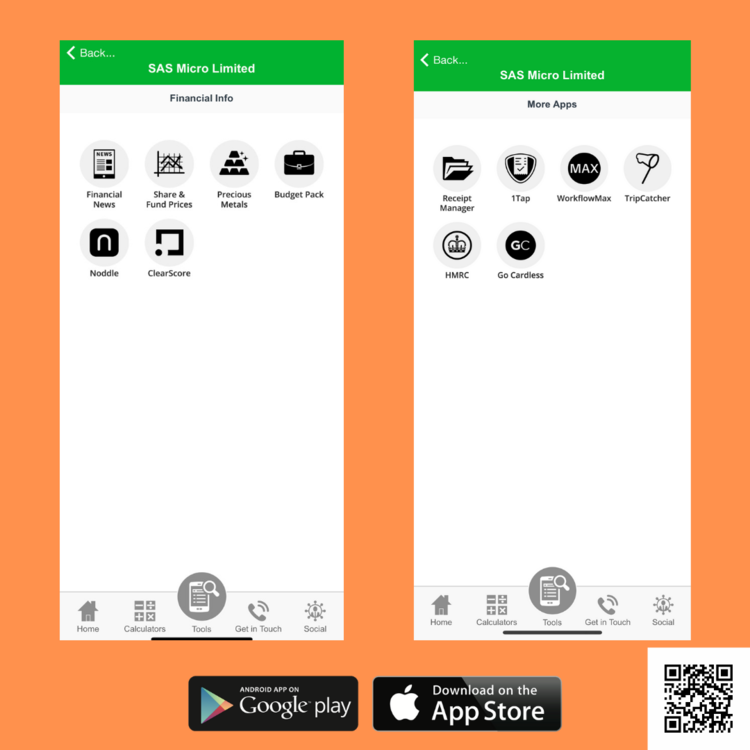

Finally, download our FREE app as you can access all this and more in one place!

Our app harnesses all the key calculators, software and applications all in one place. View your HMRC online account and then seamlessly switch into Xero or Receipt Bank. View our blog or meet the team, all just a few taps away.

Looking to get set-up as a limited company or to ask for a pay-rise? Check what your take-home pay would be plus what taxes you would be subject to, all in our app. You name it, our app has it… company cars, mortgages, VAT, payslips, savings, capital gains and more.

From here you are able to speak to us, check out our social media and keep up-to-date with all the things which may be of benefit to you and your business.

“Neat app which lets you easily sign off any returns electronically!”

— Will – Self-assessment Client

Thanks for reading!

We hope this has been of use to you, please feel free to contact us if you have any questions.

If you have any questions click here to book a free 1-to-1.